The Ultimate List for Browsing Your Credit Repair Journey

The Ultimate List for Browsing Your Credit Repair Journey

Blog Article

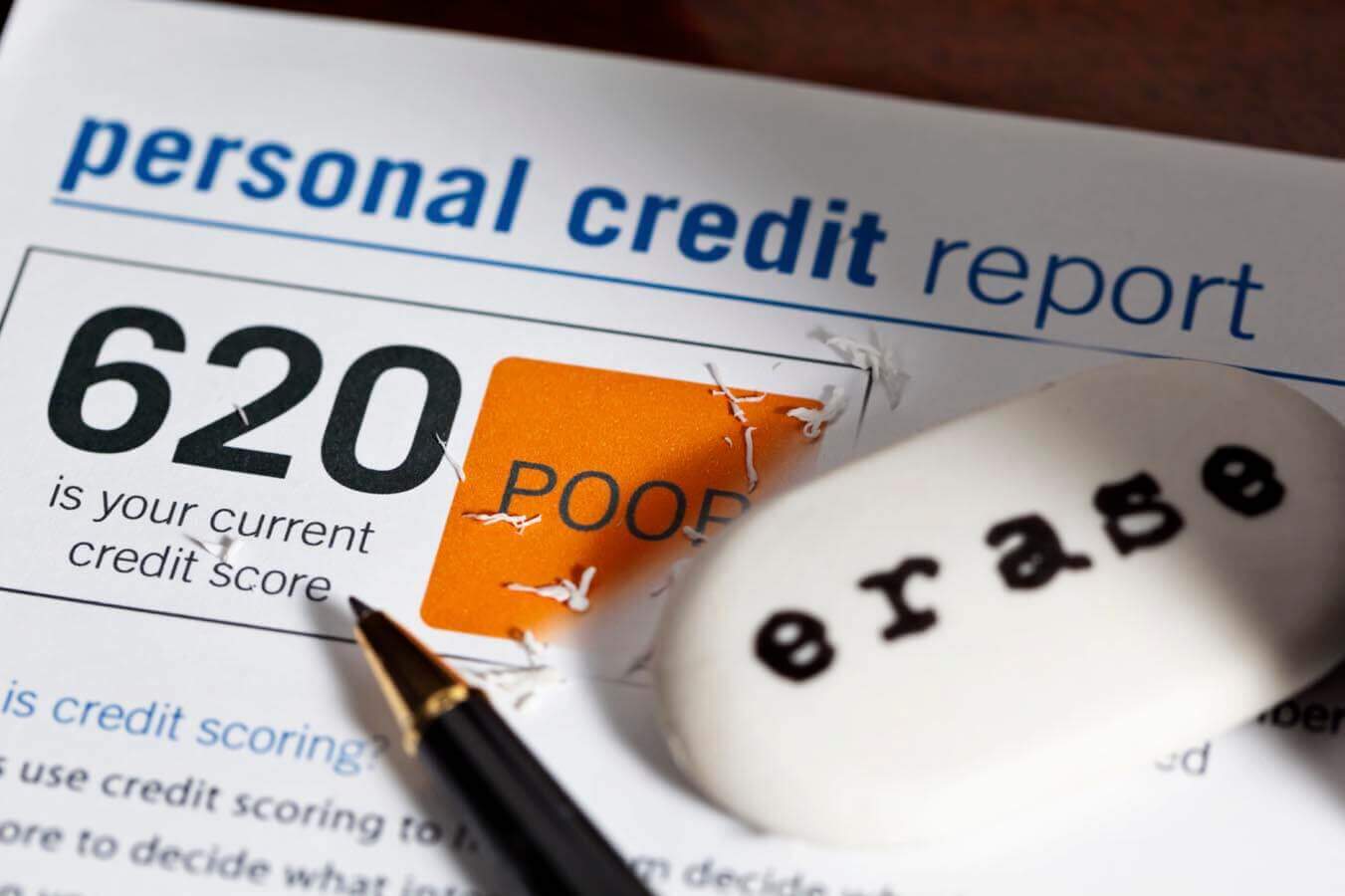

Just How Debt Repair Service Functions to Get Rid Of Errors and Increase Your Creditworthiness

Credit repair is an important process for individuals seeking to enhance their creditworthiness by dealing with inaccuracies that may jeopardize their monetary standing. By carefully examining credit rating reports for common mistakes-- such as wrong personal details or misreported repayment backgrounds-- individuals can launch a structured disagreement process with credit report bureaus. This not just corrects incorrect information yet can additionally bring about substantial enhancements in credit history. The implications of these improvements can be profound, affecting every little thing from loan authorizations to rates of interest. Understanding the nuances of this process is vital for attaining optimal outcomes.

Comprehending Debt News

Credit history reports offer as a financial snapshot of a person's credit rating history, outlining their borrowing and payment behavior. These records are assembled by credit score bureaus and include vital information such as credit report accounts, outstanding financial obligations, settlement background, and public records like personal bankruptcies or liens. Banks utilize this data to evaluate an individual's creditworthiness when getting financings, bank card, or home loans.

A credit record generally includes individual details, including the person's name, address, and Social Safety and security number, in addition to a listing of credit rating accounts, their status, and any type of late repayments. The report additionally lays out credit report inquiries-- circumstances where lending institutions have accessed the record for examination objectives. Each of these components plays a vital function in establishing a credit rating rating, which is a mathematical representation of creditworthiness.

Recognizing credit report records is crucial for consumers aiming to manage their monetary wellness successfully. By frequently reviewing their reports, people can ensure that their credit report properly reflects their economic habits, hence positioning themselves positively in future loaning endeavors. Understanding of the contents of one's credit rating record is the initial step toward effective credit history repair service and total economic well-being.

Usual Credit Report Errors

Mistakes within credit score records can dramatically influence an individual's credit report and general monetary health and wellness. Usual credit rating report errors consist of wrong personal info, such as incorrect addresses or misspelled names. These disparities can cause confusion and might affect the evaluation of credit reliability.

Another regular mistake includes accounts that do not belong to the individual, frequently resulting from identity burglary or incorrect data entrance by lenders. Mixed files, where a single person's credit scores details is integrated with another's, can additionally occur, specifically with people that share comparable names.

In addition, late payments may be incorrectly reported as a result of processing misunderstandings or errors relating to settlement dates. Accounts that have actually been cleared up or repaid might still show up as outstanding, further complicating an individual's credit score account.

In addition, mistakes relating to credit line and account balances can misrepresent a consumer's debt use ratio, a vital consider credit history racking up. Acknowledging these mistakes is necessary, as they can lead to greater rates of interest, lending rejections, and boosted trouble in getting credit rating. On a regular basis assessing one's credit rating record is a positive procedure to determine and rectify these usual errors, therefore protecting financial health.

The Credit Report Repair Refine

Navigating the debt repair process can be a difficult job for many individuals looking for to enhance their financial standing. The journey begins with getting a thorough credit scores record from all three significant credit score bureaus: Equifax, Experian, and TransUnion. Credit Repair. This allows customers to recognize and comprehend the factors impacting their credit report

Once the credit history record is examined, individuals should classify the info right into accurate, imprecise, and unverifiable things. Precise details should be kept, while mistakes can be disputed. It is important to collect sustaining paperwork to corroborate any claims of error.

Next, people can select to either manage the process separately or enlist the aid of professional debt fixing services. Credit Repair. Professionals often have the know-how and sources to browse the intricacies of credit history reporting legislations and can enhance the process

Throughout the credit rating repair process, keeping prompt settlements on existing accounts is crucial. This demonstrates accountable monetary behavior and can favorably impact credit history. Inevitably, the credit fixing procedure is a methodical strategy to recognizing concerns, Extra resources challenging inaccuracies, and cultivating healthier monetary behaviors, leading to enhanced credit reliability over time.

Disputing Inaccuracies Effectively

A reliable conflict procedure is critical for those wanting to correct errors on their credit report reports. The very first action entails obtaining a copy of your credit rating report from the major credit rating bureaus-- Equifax, Experian, and TransUnion. Testimonial the record meticulously for any type of inconsistencies, such as wrong account details, dated information, or fraudulent entrances.

Once inaccuracies are identified, it is important to gather sustaining documents that confirms your claims. This may consist of payment receipts, bank declarations, or any type of appropriate communication. Next, start the disagreement process by getting in touch with the debt bureau that provided the report. This can generally be done online, by means of mail, or over the phone. When submitting your you could try these out conflict, provide a clear explanation of the error, in addition to the supporting proof.

:max_bytes(150000):strip_icc()/how-much-does-it-cost-to-repair-my-credit-5077091Final-c21a98d1b4e9471ca8ae8b949b17d9d2.jpg)

Advantages of Credit Score Repair Work

A wide range of advantages accompanies the process of credit repair service, substantially impacting both monetary security and overall quality of life. Among the main advantages is the possibility for improved credit history. As errors and mistakes are dealt with, people can experience a notable increase in their creditworthiness, which straight influences funding approval rates and rate of interest terms.

Furthermore, credit rating repair can boost access to desirable funding options. Individuals with greater credit rating are more probable to receive lower rates of interest on home loans, car fundings, and personal car loans, eventually leading to substantial cost savings with time. This improved financial versatility can assist in significant life decisions, such as buying a home or investing in education and learning.

With a more clear understanding of their credit circumstance, people can make enlightened choices pertaining to credit score usage and administration. Credit score repair service often entails education and learning on monetary proficiency, encouraging people to take on better spending behaviors and maintain their credit history wellness long-term.

Conclusion

In conclusion, credit scores fixing serves as a vital mechanism for enhancing credit reliability by dealing with errors within debt records. By comprehending the subtleties of credit history reports and utilizing effective dispute approaches, individuals can accomplish better economic wellness and stability.

By carefully taking a look at credit report records for usual mistakes-- such as wrong individual details or misreported repayment backgrounds-- people can initiate an organized conflict procedure with credit rating bureaus.Debt records serve as an economic photo of a person's debt history, detailing their loaning and settlement behavior. Recognition of the contents of one's credit scores record is the very first action towards effective credit scores repair and overall use this link economic health.

Errors within debt reports can substantially influence a person's credit history score and total financial health.Moreover, mistakes relating to credit report limitations and account equilibriums can misrepresent a customer's credit scores application ratio, a critical variable in credit scoring.

Report this page